The hidden economics of vintage products

The nostalgia universe.

In 2025, a sealed LEGO Yellow Castle (375-2) from 1978 sold for $6,735 (more than the average monthly salary in the US).

A single Cloud City minifigure now fetches $8,209.

And it’s not just LEGO.

A vintage Rolex Submariner appreciates faster than the S&P 500. Vinyl records, mid-century furniture, and retro gaming consoles are quietly outperforming modern tech.

Why are obsolete products defying logic and gaining value faster than innovation itself?

Vintage products aren’t just things from the past, they’re emotional time machines. They help people reconnect with who they were, where they’ve been, and what made them feel something. The scratches, fading, and age don’t reduce their value. They increase it. These signs of wear prove the product has lived a story.

And that story makes it special.

Think about it like this. Say you walk into an ice cream shop and spot a flavor you loved as a child. It’s no longer in production. You ask for the price and it’s $20. That’s four times more than a regular flavor.

Is it made of rare ingredients? No.

Is it better than modern ones? Not necessarily.

But that flavor triggers memories. It reminds you of summer evenings, birthday parties, or quiet moments with family. That’s what makes it priceless. Now imagine that same emotional pull but with a discontinued LEGO set, a classic Rolex watch, or a pair of faded Levi’s jeans. That’s how vintage products hook into people’s sense of identity.

Since these products aren’t made anymore, traditional market pricing doesn’t apply. There’s no fixed price tag, no central index.

So how do sellers decide what it’s worth?

It comes down to two main forces: scarcity and emotion.

Scarcity means there's high demand and almost no supply. If people want it and can’t easily find it, they’re willing to pay more. Emotion means the product stirs up feelings like nostalgia, identity, trust, or longing. These aren’t logical forces. They’re personal. But they move markets.

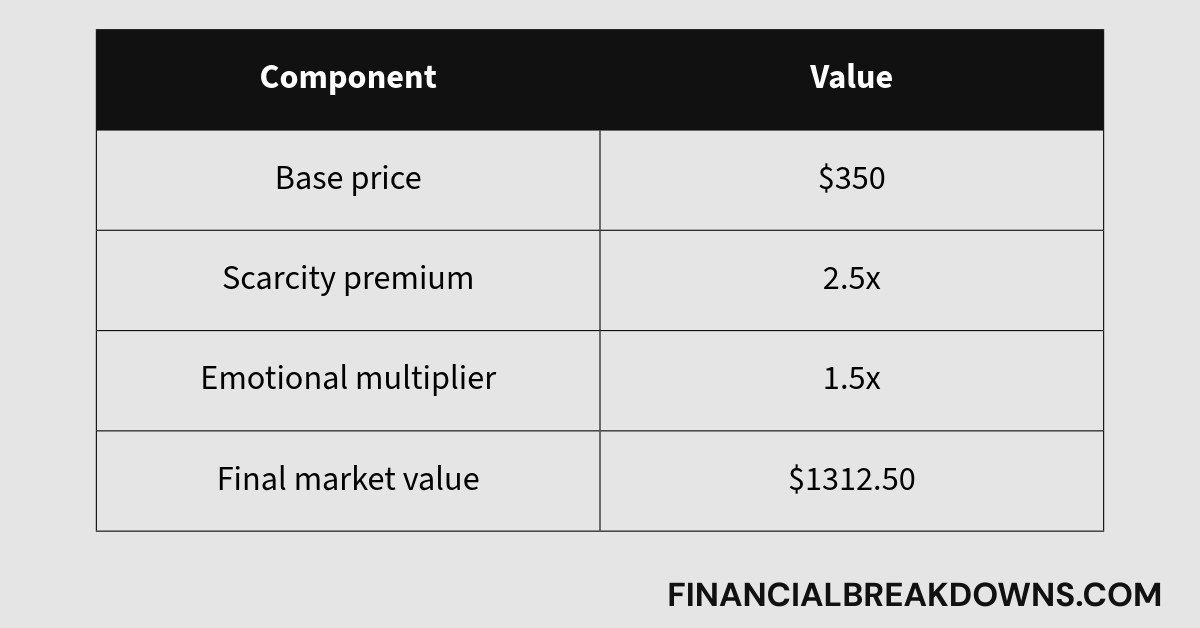

Here’s a simple way to calculate the price of a vintage item:

Base Price × Scarcity Premium × Emotional Multiplier

The base price includes the original cost of buying it (adjusted for inflation) and the cost of fixing it up or maintaining it (also inflation-adjusted).

Let’s look at a denim jacket as an example. Say someone bought it in 1978 for $15 and spent another $5 in 2009 to restore it. By 2025, the inflation-adjusted original price might be $250, and the restoration could be worth $100. That gives us a base price of $350.

Now let’s say the scarcity premium is 2.5x (because it’s rare) and the emotional premium is 1.5x (because it reminds people of a certain era, style, or music). So the resale price would be:

$350 × 2.5 × 1.5 = $1312.50

That’s how an old denim jacket becomes a collector’s item.

Scarcity premium rises when the product is no longer made, hard to find, and known among collectors. Emotional multiplier climbs when the item connects to storytelling like classic Americana fashion, faded textures, and the vibes of a past decade.

Now here’s what modern brands can learn from vintage products:

Build for emotional durability: Products that age well earn long-term trust.

Design scarcity into the story: Instead of limited editions that feel forced, create real tension around availability.

Leverage belief architecture: Help people feel that your product stands for culture, memory, and legacy.

The best products aren’t just bought and used. They’re remembered, sought after, and passed down.

Vintage isn't just about old stuff. It's about value that survives time. And surprisingly, many vintage products have performed better than gold or the stock market over the long run.

That’s because unlike numbers on a screen, vintage goods carry something deeper: emotion, trust, and meaning